What does the rise in inflation mean for your investments?

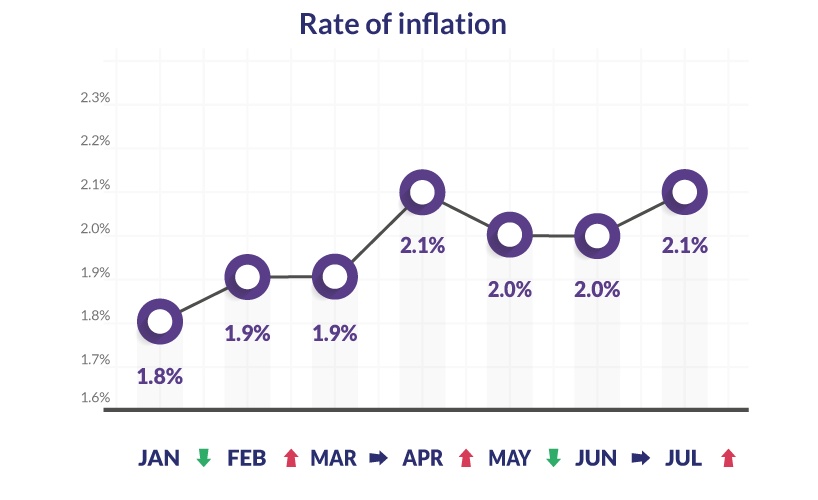

On Wednesday 14th August, the Bank of England announced that inflation in July had increased to 2.1%, going above the 2% target for the 2nd time this year.

So what is inflation and how is it measured?

Inflation is the term given to a general increase in prices and fall in the purchasing value of money. Each year the Bank of England sets its inflation target and measures it on a monthly basis.

The Bank of England's preferred indicator of inflation is the Consumer Price Index (CPI), which measures the percentage change in the price of a basket of goods and services consumed by households.

In the UK, the CPI consists of 12 categories which have different weightings. From Transport (16%) to Recreation & Culture (15%) and Food & Non-alcoholic Beverages (10%), it aims to give a balanced reflection of of the UK's spending habits.

The basket is updated annually to keep it as representative as possible, and prices are checked on a monthly basis by recording prices at outlets across the UK.

The possible winners and losers

Inflation can affect different groups of people in different ways...

| WINNERS | LOSERS |

|

|

How does inflation impact on your investment returns?

Inflation can also reduce your investment returns in real terms. If you are a taxpayer, you can help reduce this effect by using tax-free investments like our IFISA.

Use our indicative ISA calculator to find out the real value of your savings and investments.

Take the inflation challenge

- August 23, 2019