The Access Account Marketplace

Please take the time to read this information carefully if you are considering using the marketplace to set a discount – it is important that you understand fully how the new marketplace works before you begin to use it. This will also allow you to get the best from the marketplace, whether you are investing or withdrawing funds.

What is the Access Account Marketplace?

As a result of the global economic impact caused by Coronavirus, market conditions have changed significantly. In response to this, we’ve created a new marketplace for the Access Accounts to better absorb these conditions.

The Access Accounts are a large, diversified portfolio of many hundreds of property secured loans and withdrawing capital relies mainly upon there being other investors looking to buy loan holdings.

When the economy is not in what we define as Normal Market Conditions, such as during the COVID-19 outbreak, there’s typically a reduced number of investors looking to invest and increased numbers of investors looking to withdraw. This imbalance is common with many other investments such as property funds etc, and so the marketplace offers the choice for investors to alter investor demand by offering discounts when selling their loan holdings to enable withdrawal.

We have therefore introduced the Access Account Marketplace to provide additional options for investors who wish to withdraw capital more quickly, rather than wait for Normal Market Conditions to return - whilst offering a potentially more attractive proposition for those who are looking to invest.

The marketplace will automatically connect those investors looking to withdraw their funds with those looking to invest. Plus, there will be the option to apply a discount to loan holdings, which could help to speed up the withdrawal process, providing there is demand from other investors.

How does it work?

The marketplace will be made up of ‘Invest’ and ‘Withdrawal’ Instructions, set by investors who are either looking to invest in or withdraw funds from the Access Accounts. The system will look to automatically match these instructions based on the discount applied and sought, and the instructions’ position in the queue.

By default, all Withdrawal and Invest Instructions are set at par value, meaning there is no discount applied. It’s important to note, there is no requirement to apply a discount when creating a Withdrawal Instruction. These “at par” withdrawal requests will continue to receive pro-rated distribution of loan redemptions and new investment at par value and be fulfilled over time.

When investing, the marketplace will display the best available discount, if any, that some or all of your funds can be invested at. If there are no discounts available, only investment at par value will be possible immediately.

Discounting:

The discounts applied to Access Account loan holdings are set and accepted by investors looking to withdraw and invest. The amount of discount applied is at the total discretion of the investor, based on their personal liquidity needs and is not a direct result of any credit changes to the loans available in the Access Accounts.

Simply put, if you create a Withdrawal Instruction with say, a 1% discount on £100 of Access Account investments, you would receive £99 cash as soon as a matching invest instruction was found. The investor who invested in your loan holding at a discount will receive £100 worth of loan holdings for £99 – effectively getting a bonus £1 worth of loan holdings.

Discounts can be chosen based on what is currently available for immediate withdrawal or investment. Alternatively, investors can set up an instruction to invest or withdraw at a specific target discount, which will automatically be fulfilled as soon as a matching instruction is found.

Setting a discount when making a withdrawal will reduce the amount of capital you receive back from your loan holdings based on the amount of your chosen discount. Any discount you set will also apply to any cash element of your overall holding in the Quick Access Account. Please keep this in mind when deciding whether to create a withdrawal instruction at a discount. Once a withdrawal at a discount has been processed it cannot be reversed – those loan holdings will have been sold to another lender at your chosen discount.

Matching Instructions:

When an investor creates a marketplace instruction, it’s matched with the opposite instruction based on the discount available and time and date the instruction was created.

For example

Investor A – Sets a marketplace instruction on 3rd August 12:00pm to

withdraw £1000 and applies a 1% discount.

Investor B – Sets a marketplace instruction on 4th August 09:00am to

withdraw £1000 and applies a 1% discount.

Investor C – Is looking to invest £990 on 5th August

10:00am at the highest available discount.

In this scenario, providing these investors are the only investors with active marketplace instructions, Investor A would be matched with Investor C, because they are offering the highest available discount and were the first to set the marketplace instruction at that level of discount.

However, if Investor B changed their discount to 2% before the above took place, they would instead be matched with Investor C, as the Invest Instruction will always match with the best available discount – regardless of when it was set versus other Withdrawal Instructions with lower discounts.

It’s also possible for instructions to be partially matched. Using the example above, if investor C was looking to invest £1500 (and again these are the only active instructions in the marketplace) all of Investor A’s Withdrawal Instruction and part of Investor B’s instruction would be fulfilled. The remaining amount of Investor B’s Withdrawal Instruction would be fulfilled as soon as it could be matched with another Invest Instruction.

How long will it take to fulfil marketplace instructions?

This new functionality will bring an active marketplace that is better suited to more difficult market conditions and those still wanting to withdraw quickly. Unfortunately, we’re not able to predict how long this will take and we certainly cannot guarantee that a discount will lead to an immediate sale. Like any marketplace, it will depend on the demand and supply available.

How to Invest using the Access Account Marketplace

Existing Withdrawal Instructions

Firstly, it’s important to note that although you may have any number of Invest or Withdraw Instructions at the same time, you are limited to one type per Access Account i.e. you can only invest into an Access Account that doesn’t have a current Withdrawal Instruction.

Please note, Standard and IFISA-wrapped Access Accounts are treated separately, so it's possible to have a Withdrawal Instruction in the Standard 30 Day Access Account for example, and also have an Invest Instruction in the IFISA-wrapped 30 Day Access Account.

Also, we’ve removed the investment cap on the Quick Access Account (QAA), so there are now no limits on the amount of funds you can have invested across both the standard and IFISA wrapped QAA.

Transferring new funds onto the platform:

If you’re investing funds that aren’t already in your cash account, you will need to add your deposit intentions.

- Head to the ‘Manage funds’ tab in your dashboard and select deposit funds.

- Choose ‘one-off deposit’ or ‘regular deposit’ if you plan to deposit a set amount on a regular basis.

- Enter the exact amount you plan to deposit.

- If you wish to set a target discount to invest at, please make sure you transfer funds to your Cash Account, rather than directly into the Access Accounts. Funds invested directly into the Access Accounts using your unique reference number will automatically and irrevocably become invested at the biggest available discount at that point in time.

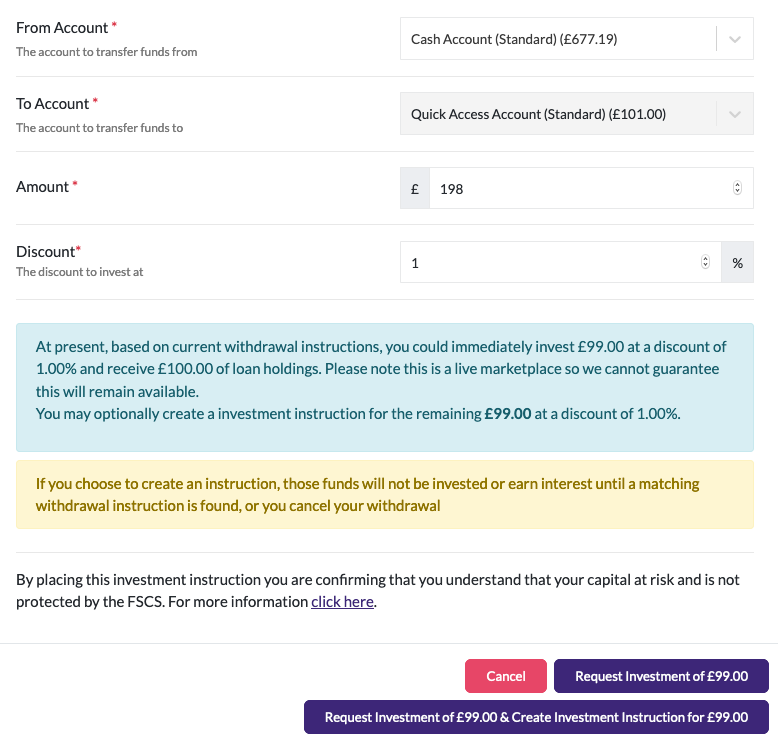

Investing from your Cash Account

- Click ‘invest’ on Access Account you would like to invest in.

- Enter the amount you would like to invest.

- The marketplace will let you know the biggest available discount that some or all of your funds can be invested at. If there are no discounts available, you can invest at par value (0% discount) immediately.

- Alternatively, you can set an instruction to invest at a discount of your choosing. However, it’s important to remember that your funds will not become invested and interest bearing until a matching withdrawal instruction is found.

Cancelling an Invest Instruction

You can cancel an Invest Instruction at any time, providing it has not already been matched. Simply head to the Access Account Marketplace box in your dashboard, select the Invest Instruction and press cancel.

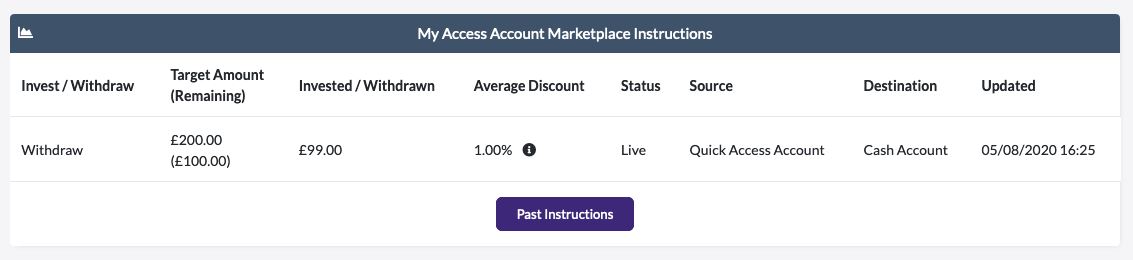

Keeping track of Invest Instructions

You can keep track of your Invest Instructions, and whether they have been fulfilled, in the Access Account Marketplace box in your dashboard.

You’ll be able to see all active instructions including any that have been fulfilled or cancelled.

Reinvesting Capital and Interest

Interest and capital repayments from any of our investment accounts can be reinvested via the Access Account Marketplace. This will automatically create a marketplace for those funds to be invested at the best available discount by default, or at par value if no discounts are available.

Alternatively, you can set a target discount to invest at, which will be fulfilled as soon as a matching Withdrawal Instruction is found. If you choose to invest at a discount, some or all of your funds will not be invested and become interest bearing until a matching Withdrawal Instruction is found. You are able to cancel these instructions at any time and have the funds that have not already been invested transferred to your Cash Account.

How to make a withdrawal using the Access Account Marketplace

Existing withdrawal requests

If you’ve already made a withdrawal request before the Access Account Marketplace went live and it’s awaiting withdrawal, you don’t need to take any further action. Your request has automatically been converted to a ‘par value’ (0% discount) marketplace instruction and will retain its position in the queue. This Withdrawal Instruction will continue to be fulfilled over time on a pro-rata basis (as is currently the case). You can find more information on how this works here. Essentially, if you don’t want to make use of the discounting feature of the new marketplace, you don’t need to take any action, your existing withdrawal request(s) will be preserved and withdrawal payments will continue on the same basis as at present.

However, if you would like to use the Access Account Marketplace to withdraw your loan holdings at a discount, to potentially speed up your withdrawal (subject to demand from buyers at the discount level you choose to set), you’ll need to cancel your original withdrawal request and create a new one.

Applying a discount to your Withdrawal Instruction

Only funds invested in the Quick Access Account (QAA) can be traded on the marketplace and at a discount. So, if you have funds that have served their notice period from the 30 Day or 90 Day Access Accounts and you want to take advantage of the discount facility, you’ll need to move some or all of your funds into the QAA in order to offer loan holdings for sale at a discount.

If you already have a pending withdrawal request from the 30DAA or 90DAA that has served its notice period but would like to offer your holdings at a discount, you’ll need to cancel those old par value withdrawal requests and direct your money to the QAA - you will earn the QAA rate of interest until any withdrawal is completed. Then follow the process below.

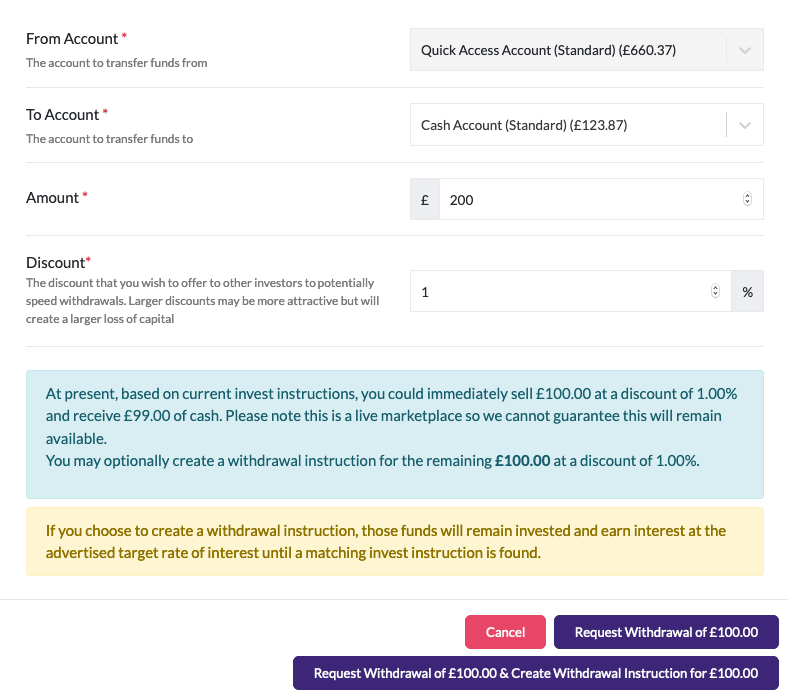

Setting a new withdrawal instruction with a discount:

- Click ‘withdraw’ on the Quick Access Account box in your dashboard.

- Select the destination you wish to withdraw your funds to and enter the amount you’d like to withdraw.

- Click on ‘Discounting Options’.

- Enter the chosen discount you’d like to sell at.

Once you’ve followed this process the system will indicate, based on current Invest Instructions, the amount of funds that are immediately available for withdrawal based on the discount you’ve chosen. Whilst we try to give you as much real-time information as possible at the point of setting a withdrawal instruction, this is a live marketplace.

Therefore, we can’t guarantee or hold the amount immediately available at a given discount for any period of time. If an Invest Instruction is no longer matched when you select withdraw, the system will reject the instruction and provide you with a new indication based on current invest instructions in the marketplace.

The amount available for withdrawal is based on demand from other investors looking to invest. So, it may not be possible to fulfil some or all your withdrawal request immediately. In this scenario, you have the option to change your chosen discount or create a marketplace instruction to automatically withdraw your funds at a discount of your choice, as soon as there is demand.

It’s really important to be comfortable with the level of discount you apply to your loan holdings: in effect, you are creating a reduction in your capital equal to the discount you choose to set. Once you have selected to withdraw any immediately available funds at a discount (and completed 2FA) the action cannot be cancelled or reversed and the funds will be processed to your chosen destination.

Before you complete the instruction, you’ll be asked to confirm the following statement:

“I understand that withdrawing my funds at a discount will reduce the amount of capital I receive and once matched with an invest instruction cannot be cancelled or reversed.”

Cancelling a Withdrawal Instruction

If you have created a Withdrawal Instruction at a target discount, you are able to cancel it at any time - providing the instruction has not already been matched with an Invest Instruction. Simply head to the Access Account Marketplace box in your dashboard, select the Withdrawal Instruction and press cancel.

For more information on the Access Account Marketplace please see our FAQs.