Blog

What's going on at Assetz Capital? These news articles, blogs and press releases will keep you up-to-date with what we're doing and what we think.

Featured

Access Account Rates Increase

- September 23, 2022

Assetz Academy celebrates its 6-month anniversary.

- August 1, 2022

The Recovery Loan Scheme

- July 28, 2021

Security on your peer-to-peer lending investments

Transparency is a part of the very fabric of crowdfunding and peer-to-peer lending, as it should be, but with this comes the reality of lending.

- May 22, 2015

We are proud to announce the launch of our new website

Direct lending for all accessible via a modern, responsively designed website

- April 24, 2015

We are attending the 2015 IFG annual conference - San Diego

The purpose of the Interface Financial Group event is to get to know the new strategic vision behind IFG’s strong position within the alternative financing marketplace.

- April 24, 2015

Investing in Peer-to-Peer Lending: What do I Need to Know?

Peer-to-peer lending has become one of the fastest growing investment sectors in the UK, more than doubling in size since 2013, with over £1.2 billion invested in 2014 alone.

- April 23, 2015

We have substanstial funds available for SMEs and Property Businesses

Our team are highly experienced in finding the right financial solution for your customers

- April 20, 2015

Assetz Capital is Now Two Years Old! Taking Peer-to-Peer to the Next Level

Back in 2010, it became clear to the founders of Assetz Capital that the current banking system was broken. This is why we set out to make a difference; not only to help restart business lending, but also to make a change for the better.

- April 20, 2015

Sowing the seeds of success

We’ve had a stellar start to 2015, confirming our place in the industry’s ‘Big Four’, thanks to our partnership with RBS and some huge external investment. We’re also part-way through a crowdfunded equity raise, offering Assetz Capital’s lenders the opportunity to acquire shares in the business through crowdfunding platform Seedrs.

- April 10, 2015

What does the 2015 budget mean for peer-to-peer lending?

The budget threw up a number of interesting scenarios for P2P lenders as well as savers in general.

To summarise the budget, we have outlined how it could impact the industry:

- March 24, 2015

P2P investors to earn a further £10m in 2015-16 thanks to bad debt relief

Net returns from peer-to-peer investments (P2P) will increase substantially from April 2015 as new rules allowing P2P lenders to offset losses against tax provide an estimated £10m in relief, according to Andrew Holgate, MD at Assetz Capital.

- March 19, 2015

Is peer-to-peer lending easy?

We’re often asked how long it takes to start lending through Assetz Capital. When registering for a bank account or applying for a bank loan, you are often asked to fill out endless amount of forms or provide every scrap of information about yourself, but thankfully peer-to-peer lending is relatively hassle free.

- March 18, 2015

The FCA Regulatory Review 2015: What Does It Mean?

In February 2015, the Financial Conduct Authority (FCA) published a regulatory review of the crowdfunding industry, including investment crowdfunding and peer-to-peer lending.

This review comes almost a year after the industry initially became regulated in March 2014, so how does the FCA think it’s gone?

- February 19, 2015

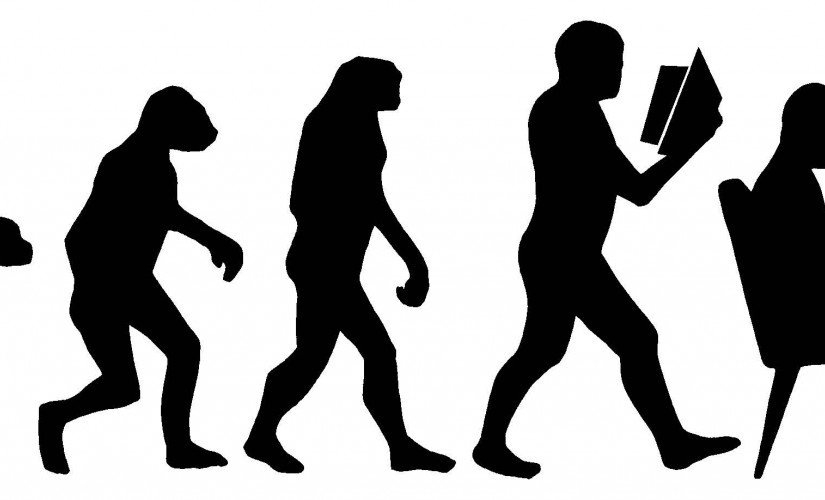

The Evolution of Peer-to-Peer Lending

Peer-to-peer business lending has come a long way in the last four years, since Funding Circle launched the first platform of this kind (P2B) in 2010. According to 2014’s Nesta Report, the UK market has grown 250% in the last two years.

For those first fledgling investors and borrowers, the industry will be almost unrecognisable by the end of 2015. As the market has grown in popularity, recognition and consequently competition, it has had to evolve significantly to meet this new demand.

- February 5, 2015

Why does the UK lead the way in peer-to-peer lending?

When it comes to alternative finance – and P2P lending in particular – the UK is in a very privileged position.

To be clear, we’re not saying that the UK market is unequivocally better than the rest of the world. The US market is more advanced in other ways (there are greater volumes of institutional money coming through, and a platform has already had an IPO out there which exceeded all but the most bullish expectations) and other countries have larger markets, but in terms of history, sophistication and lending per capita, the UK market stands tall.

- February 3, 2015

RBS and Assetz Capital - An Innovative Partnership

We are delighted to announce that we are collaborating with the Royal Bank of Scotland to help new and existing SMEs gain access to the funding they need.

- January 22, 2015

Overseas Investment For Assetz Capital

Chicago-based investment advisor Victory Park Capital has shown its support for Assetz Capital by agreeing a 5 year contract to invest up to £150 million ($228m) in loans for SMEs.

- January 21, 2015

Investing In Green Has Been A Great Success

Assetz Capital has seen the Green Energy Income Account, which lends only to renewable energy projects such as wind farms, attract more than £0.75m worth of investment since its launch late last year.

- January 20, 2015